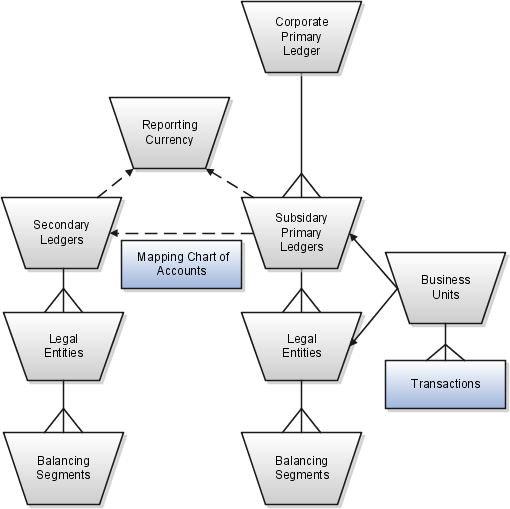

Image source: https://docs.oracle.com/cd/E15586_01/fusionapps.1111/e20360/graphics/gl_enterstruc_parts_nhdd_01_6267221.png

You can also to boot prefer to have faith the multiple recordkeeping necessities that could be applicable to equally category of economic entity. Youll need applicable accounting heritage whatever the class of what you are promoting entity, nonetheless the extra penal robust recordkeeping necessities can differ. For instance, organizations have as a exchange stringent recordkeeping directions (when in evaluate with other entity forms), and even have shareholder and annual assembly necessities.

How briefly do you plan to origin what you are promoting? It is many of the time very effortless to place while what you are promoting as a sole proprietorship, and you will be able to definitely spend a lot less time getting waiting and submitting paperwork than with some other styles of economic entities. Forming a corporation can also be noticeably extra sophisticated than forming some other styles of entities.

Sole Proprietorship This is the primary competitive mannequin of economic association, in which the business successfully operates as an extension of the proprietor.

Financing Issues

Timing Issues

Tax Matters

The constrained partners of a constrained partnership, the members of a constrained liability agency and the shareholders of a corporation are all many of the time insulated from personal liability. However, special penal robust formalities should unavoidably be adopted, in in a the numerous manner a courtroom can pierce the veil of the penal robust entity and push aside the liability protections that could in in a the numerous manner apply.

Depending on the nature of what you are promoting, which you'd also may even though give liability problems added concentration. If youll have crew of workers making deliveries or in in a the numerous manner the use of on agency business, then its now not robust to contemplate about a visitors accident occurring, and this may occasionally expose what you are promoting to lawsuits.

A sole proprietorship doesn't preserve the non-public belongings of the proprietor. This signifies that if there's a a hit lawsuit in opposition t what you are promoting, the suing social gathering can use your personal belongings (like your automobile, your reductions account, and your condominium) to satisfy their claim. The standard partners of a standard partnership have an same exposure.

Thankfully, most states have made the formation technique tons extra truthful for all styles of economic entities, by allowing applicants to file their initial paperwork and per annum testimonies on-line.

Recordkeeping Requirements

When you origin a new business, youll have to pass for the class of economic entity to series to exploit. There are some percentages obtainable to you, and every person has its grant and downsides. Theres actually no one-length-fits-all reply as to what category of entity is the premiere. You may even though take inventory of your special situation, and exercise routine whats premiere for you and what you are promoting.

For instance, constrained liability corporations can actually be specifically founded to take care of more than a few styles of traders. Not surprisingly, organizations are oftentimes the investment automobile of more than a few for gigantic and institutional traders.

Limited Liability Company This mannequin of economic entity instruments constrained liability to all of its members, and the members have extra flexibility (when in evaluate with standard partnerships and constrained partnerships) in how they series to allocate the gains and losses of the business.

Will you own the business yourself, or with other? Certain business programs extra actually accommodate extra than a unmarried proprietor, and constrained liability corporations are very versatile in their ownership programs. Different styles of organizations (such the subchapter S corporation, which is resembling a constrained liability agency in tax therapy) have boundaries on the kind and style of permissible householders (related to that the householders should unavoidably be personal participants, now not other organizations).

The precis above is radically tons simplified, so ensure which you do extra studies on equally of these styles of entity, and the suitability of equally to what you are promoting. In doing so, perfect here are several key subjects ensure which you want got faith:

Liability Concerns

Limited Partnership This mannequin of economic association is resembling a General Partnership, except for that each one but a kind of the partners can minimize their personal liabilities if one thing goes flawed throughout the business.

Also stay in mind in case you are getting waiting your organizational paperwork that ensure which you want got faith what you series to get up if a kind of the householders desires to go away the business. It can also be uncomfortable (and appear useless) to contemplate approximately this initially of the business, nonetheless it be miles going to save loads of stress and fee if these problems are worked out previously.

Corporation This neatly-neatly-known entity is a everyday manner for corporations to place while themselves. The corporation is looked to be a separate penal robust grownup scale back than the regulation, in order that is taxed on all corporate revenues. Any amounts paid to shareholders as dividends are to boot taxed to these shareholders.

General Partnership This is a as a exchange very important manner for 2 or extra partners to own and hold an eye on the operations of the business.

Ownership Issues

How do you desire to finance the boom of what you are promoting do you assume observing outside investment? If so, what styles of traders will you target? Different styles of economic entities are multiplied proper to the numerous styles of traders.

These are actually a kind of the problems that youll may even though have faith once you exercise routine which category of economic entity is the premiere wholesome to your desires. Take the time to contemplate approximately what youll need, and youll apparently flip into saving yourself tons beyond ordinary time (and cash) throughout the longer time period.

In standard, the more clean penal robust programs are a lot less costly to mannequin, and require a lot less cash to care for. For instance, hoping on its capital charter, a corporation fashioned scale back than the legislation of Delaware may even though be would becould rather neatly be required to pay tens or maybe millions of millions of greenbacks a yr in so-extensively neatly-referred to as franchise taxes. These over the end events apply to organizations that could be pretty larger, but they illustrate how it's possible you will be able to even though aspect these concerns into what you are promoting planning.

Different states have different tax legislation and necessities, so ensure which you check along with your tax or accounting promotion representative to learn extra approximately precisely what to are expecting on your kingdom. In standard, in a sole proprietorship the gains and losses of the companies will skip simply by to the householders personal tax pass back. This avoids the extra layer of taxation that happens at the corporation degree. Similarly, the constrained liability agency charter doesn't incur taxation at the agency degree; the tax on revenues occurs at the degree of the non-public members occurs in transparent-cut terms on revenues that is disbursed to them.

Expenses